how to find out from irs what 1099s submitted

Important Announcement | The IRS changed the 1099 MISC and reintroduces the newly required 1099 NEC form concluding revenue enhancement season and those changes are still in consequence. A variety of changes have been implemented, but most notably the 1099 NEC grade has been resized and the agenda twelvemonth is at present a fillable field (see screenshots below).

End of yr accounting tasks are one of the biggest stressors for property managers and that includes getting prepared for sending out 1099s.

Last year, the IRS has made significant changes to the 1099 forms and deadlines; from irresolute the 1099 MISC form to reintroducing the 1099 NEC (nonemployee compensation) form.

As the IRS requires holding managers to issue a 1099 taxation form to owners, contractors, and professionals who received more than than $600 related to rental business activeness, it'due south important to know the details of those form changes, deadlines, and requirements.

What is a 1099 and Why Does the IRS Demand Them?

The IRS relies on 1099s to monitor outside and miscellaneous income sources that are not recorded on a traditional West-two form which reports on salaries and wages. This means that 1099s are a way for the IRS to capture independent contractors or belongings possessor's income that might otherwise go unreported. While a holding possessor or independent contractor is required to honestly written report all earnings, the IRS relies on you lot to assist reinforce the required income reporting information.

1099 Reporting Related to Property Direction

For most three decades, the 1099 MISC was the but form to written report all payments of $600 or more to owners for rents received and for the work service providers performed related to the rental business. However, last twelvemonth the IRS decided to revive t he 1099 NEC (nonemployee compensation form) and subsequently revamped the 1099 MISC which in essence separates out those two groups.

Who Gets a 1099 Form?

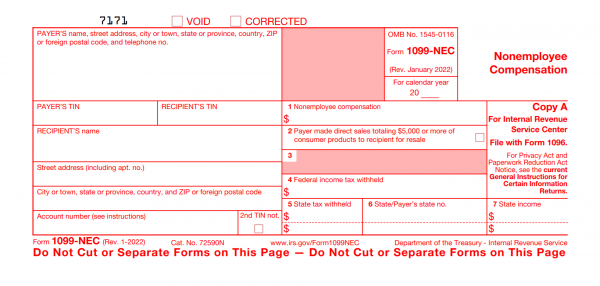

1099 NEC Course

Apply this class to written report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or LLCs) that performed piece of work for you related to the rental business. This tin include:

Repairmen

Plumbers

Carpenters

Landscapers

HVAC professionals

Locksmiths

Cleaning services

COVID-related services such equally sanitizing services

Current 1099 NEC Form Pattern

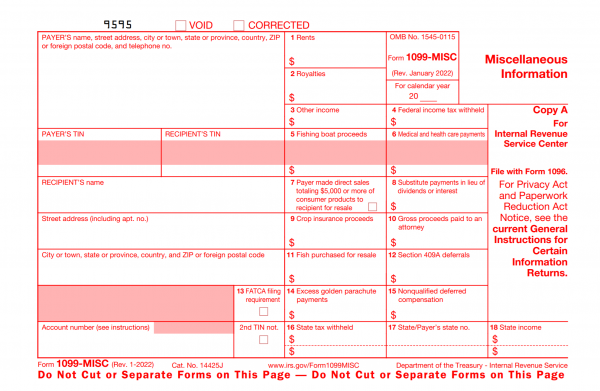

1099 MISC Form

The 1099-MISC form there are two reasons a property management company or landlord will use the 1099 MISC form is to study payments of over $600 in a calendar year for:

- Rent sent to owners (owner disbursements, also called possessor distributions) and

- Attorney fees such as to handle an eviction or collect unpaid rent (even if the legal services were provided by a corporation).

The Redesign Changes

In addition to other 1099 changes, in relation to property management, the following 1099 MISC boxes changed co-ordinate to the IRS:

- Study gross proceeds to an attorney in box 10.

- And for those submitting combined federal and country forms, box xv is to study state taxes withheld, box 16 is the state identification number, and box 17 is for the amount of income earned in the state.

Current 1099 MISC Form Pattern

Specia l Note : Considering of the 1099 changes last year, if you lot are behind in filling out the previous years 1099s, exist sur e to contact your auditor and/or the IRS for detailed instructions.

1099 Filing Exemptions

No need to file a vendor or possessor 1099 when the payments in a calendar year total less than $600 or were made to purchase goods not services. In add-on, there are a few additional exceptions to the 1099 requirements for property managers

1099-MISC Exception : 1099s demand not be filed if the rental property possessor is a corporation. This means if a corporation owns the rental belongings, you lot do not need to submit a 1099 MISC form to document possessor distributions sent to the corporation.

*This exception but applies if the property (or property portfolio) has been fix up equally a corporate entity. Information technology does not apply to attorney fees paid to a legal corporate entity. Chaser fees over $600 require to be submitted on a 1099 MISC form regardless of business structure.

1099-NEC Exception : Payments to an incorporated business who perform maintenance, repairs, or other services related to a customer'south rentals are exempt from receiving a 1099-NEC form.

Of import Note: The IRS has complex rules and with that, the exceptions above have exceptions and nuances that become beyond the scope of this article. For instance. a vendor operating as an LLC tin can opt to be treated every bit C or S corporation for tax purposes and and so is also exempt from receiving 1099s in many cases. To be sure you are offer 1099s accordingly, exist sure to bank check current IRS instructions, consult a tax advisor, and take electric current W9s on file to aid you decide if the company is exempt or not.

Helpful Resource: 2021 Instructions for Forms 1099-MISC and 1099-NEC

What Data Do I Need to File 1099s?

For each individual or entity that yous intend to file a 1099 for, you lot will need their:

Tax ID Number | For individuals, this is their social security number (SSN), for businesses, it's their employer identification number (EIN).

Address | This allows you to ship the recipient a required copy for their taxation reporting requirements.

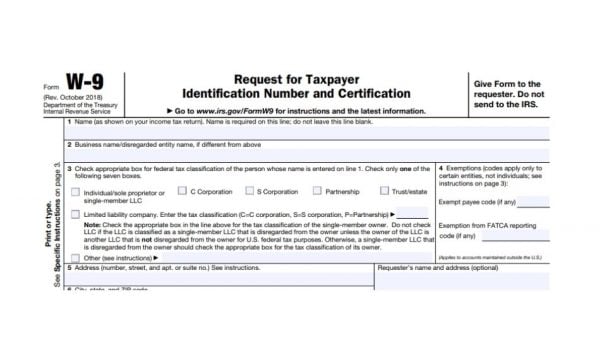

Funds Paid | Yous will need to know the cumulative amount of money issued to the individual during the tax twelvemonth. Your owners' and vendors' taxation ID number and address tin can be captured via a W-9 form . A W-9 course is an official IRS document used to requestand certify a taxpayer's identification number and address. 1099 Time-Saving Tips

1099 Time-Saving Tips

- It is always a good idea to require a vendor or owner to fill out a W-nine when you beginning engage in business concern with them then you do non take to scramble for this information come revenue enhancement reporting time.

- Request for an updated Westward-9 yearly volition ensure y'all always take their about current address and information and aren't caught surprised past any changes in their business.

- It's not too late to ship a Due west-ix to owners and vendors earlier 1099s are due. IRS Westward-9 information, instructions, and .pdf course can be found hither: Almost Course West-ix

1099 Requirements for Rental Owners

If yous self-manage the rental property you own, you may wonder almost your 1099 requirements. Back in 2009, a clause in the Affordable Care Act required rental owners to report 1099-MISC income paid to service providers in relation to the rental holding. In 2010, the clause was further clarified with the Small Business concern Jobs Deed and the Wellness Care Reform Bill. But, past 2011 the requirement was repealed , making it not necessary for individual landlords to file 1099s to vendors for work related to their own rental holding.*

*That said, the penalties for failing to file 1099 tax documents are high, so y'all should ever speak with a taxation professional who is familiar with rental real estate revenue enhancement requirements if you accept any questions or require further clarification.

When are 1099s Due?

*State deadlines vary

Federal 1099-NEC Deadlines

Both the IRS and recipients must receive their respective copies (regardless or filing by paper or electronically) on or before January 31, 2022.

Federal 1099-MISC Deadlines

The 1099-MISC re-create must accomplish the IRS and recipient on or before February 28, 2022 if newspaper filing, or March 31,2022 if y'all file electronically. Note: If yous written report any amounts in box 8 or 10, the deadline is February 15, 2022. This also applies to statements furnished as part of a consolidated reporting argument.

More information on due dates can be constitute on the Guide to Information Returns on page 26 of this IRS publication | 2021 General Instructions for Sure Data Returns

Remember, the penalties for declining to file 1099s can be costly so it is important to understand your obligations when information technology comes to 1099 requirements for your rental business. Information technology's always recommended that y'all speak with your accountant or a tax professional with specific questions about your taxes and upcoming deadlines.

How do I File 1099s for my Property Management Concern?

As both the 1099 MISC and 1099 NEC have different IRS filing deadlines and yet those deadlines are different from when the recipient must receive them, it tin can become complicated to coordinate that timing.

The simplest style to file your 1099s with the IRS and ship them out to recipients is to practice so electronically, or eastward-file.

Of course, yous too accept the pick to postal service 1099 Taxation Forms to the IRS, nonetheless, any business that submits more than than 250 1099-MISC Forms must file electronically.

Belongings direction software makes it easy for property managers to complete 1099s and come across your tax reporting requirements. Your property direction software should e'er have integrated accounting features that records possessor and vendor payments made throughout the year and will generate like shooting fish in a barrel-to-read reports summarizing your vital tax reporting information.

The right software will provide you with a way to file your reports online from your account (e-file) or impress out a revenue enhancement assistant report to requite your CPA or use for manually filing 1099s.

Desire to utilize Rentec Direct to electronically file your 1099 taxation documents? It's easy with the 1099 Revenue enhancement Assistant and integrated e-file functions. Property managers and landlords can notice convenient due east-filing options for 1099s within their rental management software.

Through services like Rentec Direct, 1099s are automatically generated based on your financial records and vendor payments recorded throughout the twelvemonth, so sending 1099s to recipients and filling them with the IRS is a cakewalk.

This updated article originally posted 12/04/2020 and is to help understand the 1099 changes and does not constitute legal advice. Please consult with your tax professional regarding your 1099 obligations and deadlines.

RELATED READING FOR Yous:

- Landlord 1099 Requirements | What is a 1099 and Do I Demand to File

- Revenue enhancement Tips for Rental Properties & Rental Income and Deductions for Landlords

- Rental Property Accounting Tips and Tricks for Landlords and Property Managers

Source: https://www.rentecdirect.com/blog/1099-nec-and-1099-misc-changes-and-requirements-for-property-management/

0 Response to "how to find out from irs what 1099s submitted"

Postar um comentário