what did clinton do to balance the budget

The economic policies of Bill Clinton administration, referred to past some every bit Clintonomics (a portmanteau of "Clinton" and "economics"), encapsulates the economical policies of United States President Beak Clinton that were implemented during his presidency, which lasted from January 1993 to Jan 2001.

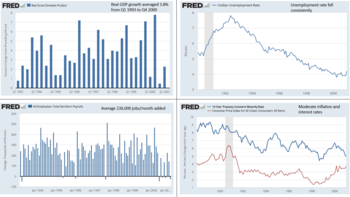

President Clinton oversaw a very robust economic system during his tenure. The U.S. had strong economic growth (around iv% annually) and record job cosmos (22.7 million). He raised taxes on higher income taxpayers early in his first term and cutting defense spending and welfare, which contributed to a rising in revenue and refuse in spending relative to the size of the economy. These factors helped bring the United states of america federal upkeep into surplus from the financial year 1998 to 2001, the only surplus years later 1969. Debt held by the public, a chief measure of the national debt, fell relative to Gdp throughout his two terms, from 47.8% in 1993 to 31.4% in 2001.[1]

Clinton signed North American Gratis Trade Agreement (NAFTA) into law, forth with many other complimentary trade agreements. He also enacted significant welfare reform. His deregulation of finance (both tacit and overt through the Gramm–Leach–Bliley Deed) has been criticized equally a contributing factor to the Swell Recession.[2]

Overview [edit]

4 charts showing existent GDP growth, unemployment rate, non-farm jobs added, inflation rate, and interest rates in the Clinton era.

Clinton'due south presidency included a great period of economic growth in America's history. Clintonomics encompassed both a prepare of economic policies likewise as governmental philosophy. Clinton's economic (clintonomics) approach entailed modernization of the federal regime, making it more enterprise-friendly while dispensing greater authority to land and local governments. The ultimate goal involved rendering the American government smaller, less wasteful, and more than agile in light of a newly globalized era.[three]

Clinton causeless role post-obit the end of a recession, and the economic practices he implemented are held upwards by his supporters as having fostered a recovery and surplus, though some of the president's critics remained more skeptical of the cause-effect upshot of his initiatives. The Clintonomics policy focus could be encapsulated by the following four points:

- Establish fiscal subject area and eliminate the budget deficit

- Maintain low interest rates and encourage private-sector investment

- Eliminate protectionist tariffs

- Invest in human uppercase through educational activity and enquiry

Prior to the 1992 presidential entrada, America had undergone twelve years of bourgeois policies implemented past Ronald Reagan and George H. W. Bush-league. Clinton ran on the economic platform of balancing the budget, lowering inflation, lowering unemployment, and continuing the traditionally conservative policies of complimentary trade.

David Greenberg, a professor of history and media studies at Rutgers University, opined that:

The Clinton years were unquestionably a time of progress, especially on the economic system ... Clinton'southward 1992 slogan, 'Putting people commencement,' and his stress on 'the economic system, stupid,' pitched an optimistic if still gritty populism at a middle class that had suffered nether Ronald Reagan and George H.W. Bush-league. ... By the finish of the Clinton presidency, the numbers were uniformly impressive. Besides the record-loftier surpluses and the tape-depression poverty rates, the economic system could boast the longest economical expansion in history; the everyman unemployment since the early 1970s; and the everyman poverty rates for single mothers, blackness Americans, and the aged.[4]

Financial policy [edit]

The Ominibus Upkeep Reconciliation Act of 1993 increased the average federal tax rates for the acme one%, while lowering boilerplate taxation rates for the center class.

Job Growth past U.Due south. president, measured equally cumulative pct modify from month subsequently inauguration to cease of term. More jobs were created under the Clinton administration than whatever other President.

Taxation reform [edit]

In proposing a plan to cut the deficit, Clinton submitted a budget and corresponding tax legislation that would cut the deficit by $500 billion over five years by reducing $255 billion of spending and raising taxes on the wealthiest 1.2% of Americans.[five] Information technology also imposed a new energy tax on all Americans and subjected about a quarter of those receiving Social Security payments to higher taxes on their benefits.[6]

Republican Congressional leaders launched an aggressive opposition against the beak, claiming that the tax increment would only make matters worse. Republicans were united in this opposition, and every Republican in both houses of Congress voted against the proposal. In fact, it took Vice President Gore's tie-breaking vote in the Senate to laissez passer the bill.[7] Later extensive lobbying by the Clinton Administration, the House narrowly voted in favor of the bill by a vote of 218 to 216.[8] The upkeep bundle expanded the earned income revenue enhancement credit (EITC) as relief to low-income families. It reduced the amount they paid in federal income and Federal Insurance Contributions Act taxation (FICA), providing $21 billion in relief for 15 meg depression-income families.

Clinton signed the Omnibus Upkeep Reconciliation Act of 1993 into law. This act created a 36 percent to 39.6 percent income tax for high-income individuals in the pinnacle 1.2% of wage earners. Businesses were given an income tax rate of 35%. The cap was repealed on Medicare. The taxes were raised four.3 cents per gallon on transportation fuels and the taxable portion of Social Security benefits were increased.

Clinton enacted Small Concern Job Protection Act of 1996 which reduced taxes for many pocket-sized business organisation. Furthermore, he signed legislation that increased the taxation deduction for self-employed business owners from 30% to lxxx% past 1997. The Taxpayer Relief Act reduced some federal taxes. The 28% rate for upper-case letter gains was lowered to xx%. The 15% rate was lowered to 10%. In 1980, a tax credit was put into identify based on the number of individuals under the historic period of 17 in a household. In 1998, information technology was $400 per child and in 1999, it was raised to $500. This Act removed from taxation profits on the auction of a house of up to $500,000 for individuals who are married, and $250,000 for unmarried individuals. Educational savings and retirement funds were given tax relief. Some of the expiring tax provisions were extended for selected businesses. Since 1998, an exemption could be taken out for those family farms and small businesses that qualified for it. In 1999, the correction of aggrandizement on the $10,000 almanac gift tax exclusion was achieved. By the year 2006, the $600,000 manor tax exemption had risen to $1 1000000.

The economy connected to grow, and in February 2000 information technology broke the record for the longest uninterrupted economic expansion in U.S. history.[9] [x]

After Republicans won control of Congress in 1994, Clinton vehemently fought their proposed tax cuts, believing that they favored the wealthy and would weaken economic growth. In August 1997, however, Clinton and Congressional Republicans were finally able to reach a compromise on a bill that reduced capital proceeds and manor taxes and gave taxpayers a credit of $500 per child and taxation credits for higher tuition and expenses. The pecker also called for a new individual retirement account (IRA) chosen the Roth IRA to permit people to invest taxed income for retirement without having to pay taxes upon withdrawal. Additionally, the police force raised the national minimum for cigarette taxes. The next yr, Congress approved Clinton'due south proposal to make college more affordable past expanding federal student financial aid through Pell Grants, and lowering interest rates on student loans.

Clinton also battled Congress near every session on the federal budget, in an attempt to secure spending on educational activity, regime entitlements, the environs, and AmeriCorps–the national service program that was passed by the Democratic Congress in the early days of the Clinton administration. The 2 sides, however, could not find a compromise and the budget battle came to a stalemate in 1995 over proposed cuts in Medicare, Medicaid, pedagogy, and the environment. After Clinton vetoed numerous Republican spending bills, Republicans in Congress twice refused to pass temporary spending authorizations, forcing the federal authorities to partially shut down because agencies had no upkeep on which to operate.[11] In April 1996, Clinton and Congress finally agreed on a budget that provided money for government agencies until the end of the fiscal twelvemonth in Oct. The upkeep included some of the spending cuts that the Republicans supported (decreasing the cost of cultural, labor, and housing programs) just also preserved many programs that Clinton wanted, including educational and environmental ones.

Deficits and debt [edit]

Below are the budgetary results for President Clinton's two terms in office:

- He had upkeep surpluses for financial years 1998–2001, the only such years from 1970 to 2018. Clinton's last 4 budgets were counterbalanced budgets with surpluses, beginning with the 1997 upkeep.

- The ratio of debt held by the public to GDP, a primary measure out of U.Due south. federal debt, vicious from 47.8% in 1993 to 33.6% past 2000. Debt held by the public was actually paid down by $453 billion over the 1998-2001 periods, the only time this happened between 1970 and 2018.

- Federal spending fell from 20.vii% Gdp in 1993 to 17.6% GDP in 2000, below the historical average (1966 to 2015) of 20.2% GDP.

- Tax revenues rose steadily from 17.0% GDP in 1993 to twenty.0% Gdp in 2000, well above the historical boilerplate of 17.4% Gdp.

- Defense spending cruel from four.3% Gross domestic product in 1993 to 2.9% Gross domestic product by 2000, equally the U.S. enjoyed a "peace dividend" in the wake of the fall of the Soviet Union. In dollar terms, defence spending vicious from $292B in 1993 to $266B by 1996, then slowly rose to $295 billion past 2000.

- Not-defence discretionary spending cruel from three.vi% Gdp in 1993 to 3.two% Gross domestic product by 2000. In dollar terms, it grew from $248B in 1993 to $343B in 2000; robust economic growth still enabled the ratio to fall relative to GDP.[one]

These surpluses 1998-2001 were attributed to a stiff economy generating high tax revenues, tax increases on upper-income taxpayers, spending restraint, and majuscule gains tax revenue from a stock market smash.[12] This design of raising taxes and cutting spending (i.e., austerity) in an economic boom coincides precisely with the communication of John Maynard Keynes, who stated in 1937: "The boom, not the slump, is the right time for austerity at the Treasury."[13] However, this remarkable success did not end conservative pundits from trying to ignominy this accomplishment. Their argument essentially goes similar this: Although debt held by the public was reduced, the surplus funds paid into Social Security were used to pay those bondholders, in effect borrowing from one pocket (future Social Security program recipients) to pay down the other (current bondholders), such that total debt rose. However, while this is true, this is too how the proverbial "math works" for all the other modern Presidents as well. It is non accurate to discredit the exceptional fiscal austerity of the Clinton era relative to other modern Presidents, which nevertheless coincided with a booming economic system by virtually any measure.[14] Information technology is besides relevant to point out that this booming economic system occurred despite Republican warnings that such revenue enhancement increases on the highest income taxpayers would slow the economy and job creation. Perhaps the blast would accept been even greater if larger deficits had been run, only this was not the argument fabricated at the time.

Welfare reform [edit]

On taking office in early 1993, Clinton proposed a $xvi billion stimulus packet primarily to aid inner-metropolis programs desired by liberals. Still it was rapidly defeated by a Republican filibuster in the Senate.[15] Serious efforts at welfare reform required bipartisan back up. With the Republican congressional landslide in 1994, Clinton was forced to triangulate policies, that is adopt largely conservative proposals supported past nearly Republicans, while claiming the major credit for them. [sixteen]

The Personal Responsibility and Work Opportunity Human action (PRWORA) of 1996 established the Temporary Aid for Needy Families (TANF) program, which was funded by block grants to us. This program replaced the Help to Families with Dependent Children (AFDC) program, which had open up-concluded funding for those who qualified and a federal friction match for state spending. To receive the full TANF grant amounts, states had to see certain requirements related to their own spending, as well as the percentage of welfare recipients working or participating in training programs. This threshold could be reduced if welfare caseloads fell. The law also modified the eligibility rules for means-tested benefits programs such every bit food stamps and Supplemental Security Income (SSI).[17]

CBO estimated in March 1999 that the TANF basic block grant (authority to spend) would total $16.5 billion annually through 2002, with the amount allocated to each state based on the state'southward spending history. These cake grant amounts proved to exist more than u.s. could initially spend, as AFDC and TANF caseloads dropped by xl% from 1994 to 1998 due to the booming economic system. As a result, states had accumulated surpluses which could be spent in future years. States also had the flexibility to utilize these funds for child care and other programs. CBO also estimated that TANF outlays (actual spending) would total $12.6 billion in fiscal years 1999 and 2000, abound to $14.2 billion by 2002, and reach $19.4 billion by 2009. For scale, total spending in FY 2000 was approximately $2,000 billion, so this represents around 0.six%. Further, CBO estimated that unspent balances would grow from $7.ane billion in 2005 to $25.4 billion past 2008.[18]

The law's upshot goes far beyond the minor upkeep impact, however. The Brookings Establishment reported in 2006 that: "With its accent on work, time limits, and sanctions confronting states that did not place a large fraction of its caseload in work programs and against individuals who refused to encounter state work requirements, TANF was a historic reversal of the entitlement welfare represented past AFDC. If the 1996 reforms had their intended effect of reducing welfare dependency, a leading indicator of success would exist a declining welfare caseload. TANF administrative data reported by states to the federal government show that caseloads began failing in the spring of 1994 and fell even more rapidly subsequently the federal legislation was enacted in 1996. Between 1994 and 2005, the caseload declined about 60 percent. The number of families receiving cash welfare is now the everyman it has been since 1969, and the per centum of children on welfare is lower than it has been since 1966." The effects were peculiarly significant on single mothers; the portion of employed single mothers grew from 58% in 1993 to 75% by 2000. Employment among never-married mothers increased from 44% to 66%. The study concluded that: "The pattern is clear: earnings upward, welfare down. This is the very definition of reducing welfare dependency."[19]

Trade [edit]

Studies washed by Kate Bronfenbrenner at Cornell University showed the adverse issue of plants threatening to move to United mexican states because of NAFTA.[20]

Clinton made it one of his goals as president to pass merchandise legislation that lowered the barriers to merchandise with other nations. He bankrupt with many of his supporters, including labor unions, and those in his own party to back up gratis-trade legislation.[21] Opponents argued that lowering tariffs and relaxing rules on imports would price American jobs because people would buy cheaper products from other countries. Clinton countered that costless trade would help America because it would allow the U.S. to boost its exports and abound the economy. Clinton also believed that free trade could help move strange nations to economic and political reform.

The Clinton administration negotiated a full of almost 300 trade agreements with other countries.[22] Clinton's final treasury secretary, Lawrence Summers, stated that the lowered tariffs that resulted from Clinton'southward trade policies, which reduced prices to consumers and kept aggrandizement low, were technically "the largest tax cut in the history of the world."[23]

NAFTA [edit]

The three-nation NAFTA was signed by President George H. West. Bush during December 1992, awaiting its ratification by the legislatures of the three countries. Clinton did non alter the original understanding, but complemented information technology with the North American Agreement on Environmental Cooperation and the North American Understanding on Labor Cooperation, making NAFTA the first "green" merchandise treaty and the first trade treaty concerned with each country'due south labor laws, admitting with very weak sanctions.[24] NAFTA provided for gradually reduced tariffs and the cosmos of a free-trade bloc of Northward American countries–the United States, Canada, and Mexico. Opponents of NAFTA, led by Ross Perot, claimed information technology would strength American companies to move their workforces to United mexican states, where they could produce goods with cheaper labor and send them back to the United States at lower prices. Clinton, withal, argued that NAFTA would increase U.South. exports and create new jobs. Clinton while signing the NAFTA pecker stated: "...NAFTA ways jobs. American jobs, and good-paying American jobs. If I didn't believe that, I wouldn't back up this agreement."[25] He convinced many Democrats to join near Republicans in supporting trade agreement and in 1993 the Congress passed the treaty.[26]

While economists generally view gratis trade equally an overall positive for the nation'southward involved, certain groups may be adversely afflicted, such as manufacturing workers. For example:

- In a 2012 survey of leading economists, 95% supported the notion that on average, U.Due south. citizens benefited on NAFTA.[27] A 2001 Journal of Economic Perspectives review found that NAFTA was a net benefit to the United States. A 2015 study found that US welfare increased by 0.08% every bit a result of the NAFTA tariff reductions, and that US intra-bloc trade increased past 41%.

- In 2015, the Congressional Enquiry Service concluded that the "net overall issue of NAFTA on the U.S. economy appears to take been relatively modest, primarily because trade with Canada and Mexico accounts for a pocket-sized pct of U.Due south. Gdp. Still, there were worker and firm adjustment costs as the three countries adapted to more open trade and investment amidst their economies." CRS also pointed out that NAFTA to a slap-up extent set rules for behavior already underway (e.g., U.South. manufacturing companies were already moving some jobs to Mexico, thus avoiding U.S. employment regulation and unions, in efforts to maximize profits.)[28]

- The U.South. Chamber of Commerce credits NAFTA with increasing U.S. merchandise in goods and services with Canada and Mexico from $337 billion in 1993 to $1.ii trillion in 2011, while the AFL-CIO blames the understanding for sending 700,000 American manufacturing jobs to Mexico over that time.[29]

World Trade Organization (WTO) [edit]

Officials in the Clinton administration also participated in the final circular of trade negotiations sponsored by the General Agreement on Tariffs and Trade (GATT), an international trade organization. The negotiations had been ongoing since 1986. In a rare movement, Clinton convened Congress to ratify the trade agreement in the wintertime of 1994, during which the treaty was approved. As part of the GATT agreement, a new international trade body, the World Trade Organization (WTO), replaced GATT in 1995. The new WTO had stronger authority to enforce trade agreements and covered a wider range of merchandise than did GATT.

Asia [edit]

Clinton as well held meetings with leaders of Pacific Rim nations to talk over lowering trade barriers. In November 1993, he hosted a meeting of the Asia-Pacific Economic Cooperation (APEC) in Seattle, Washington, which was attended by the leaders of 12 Pacific Rim nations. In 1994, Clinton arranged an agreement in Indonesia with Pacific Rim nations to gradually remove trade barriers and open up their markets.

Clinton faced his kickoff defeat on trade legislation during his 2nd term. In November 1997, the Republican-controlled Congress delayed voting on a bill to restore a presidential merchandise say-so that had expired in 1994. The neb would have given the president the authority to negotiate merchandise agreements which the Congress was not authorized to modify–known every bit "fast-track negotiating" considering it streamlines the treaty process. Clinton was unable to generate sufficient back up for the legislation, even among the Democratic Political party.

Clinton faced yet some other trade setback in Dec 1999, when the WTO met in Seattle for a new round of merchandise negotiations. Clinton hoped that new agreements on bug such as agronomics and intellectual property could be proposed at the meeting, but the talks fell through. Anti-WTO protesters in the streets of Seattle disrupted the meetings[xxx] and the international delegates attending the meetings were unable to compromise mainly because delegates from smaller, poorer countries resisted Clinton's efforts to discuss labor and ecology standards.[31]

That aforementioned yr, Clinton signed a landmark trade agreement with the People's Republic of China. The agreement–the result of more than a decade of negotiations–would lower many merchandise barriers between the 2 countries, making it easier to export U.S. products such as automobiles, banking services, and move pictures. However, the understanding could but accept effect if Mainland china was accustomed into the WTO and was granted permanent "normal trade relations" status by the U.South. Congress. Under the pact, the United States would support China'south membership in the WTO. Many Democrats too as Republicans were reluctant to grant permanent status to Communist china because they were concerned virtually human rights in the country and the affect of Chinese imports on U.South. industries and jobs. Congress, nevertheless, voted in 2000 to grant permanent normal trade relations with Prc. Several economic studies accept since been released that indicate the increase in trade resulting lowered American prices and increased the U.S. Gross domestic product by 0.7% throughout the following decade.[32]

Agronomics [edit]

Although Governor Clinton had a large farm base in Arkansas; as president he sharply cut back up for farmers and raised taxes on tobacco. [33] At one high level policy meeting budget expert Alice Rivlin told the president she had a new slogan for his reelection campaign: "I'1000 going to end welfare as we know it for farmers." Clinton was annoyed and retorted, "Farmers are proficient people. I know we have to do these things. Nosotros're going to brand these cuts. But we don't have to feel good almost it."[34]

With exports accounting for more than a fourth of subcontract output, farm organizations joined concern interests to defeat human rights activists regarding Most Favored Nation (MFN) merchandise status for China They took the position that major tariff increases would hurt importers and consumers. They warned that Prc would retaliate to hurt American exporters. They wanted more liberal trade policies and less attention to internal Chinese human being rights abuses.[35]

Environmentalists began taking a nifty interest in agronomical policies. The feared that farming had a growing negative touch on the surround in terms of soil erosion and the devastation of wetlands. The expanding use of pesticides and fertilizers, polluted soil and h2o not just on each subcontract but downstream into rivers and lakes and urban areas equally well. [36] A major issue involved low fees charged ranchers who grazed cattle on public lands. The "animate being unit calendar month" (AUM) fee was only $i.35 and was far below the 1983 market value. The statement was that the federal regime in effect was subsidizing ranchers, with a few major corporations controlling millions of acres of grazing land. Babbitt and Oklahoma Congressman Mike Synar tried to rally environmentalists and raise fees, merely senators from the Western U.s.a. successfully blocked their proposals.[37] [38]

Congress wrote a new subcontract bill in 1995. Clinton vetoed it on December 6, 1995 because it would "eliminate the safety internet" and "provide windfall payments to producers when prices are high, but not protect family unit farm income would prices or low."[39]

Deregulation of cyberbanking [edit]

Clinton signed the bipartisan Financial Services Modernization Deed or GLBA in 1999.[40] It allowed banks, insurance companies and investment houses to merge and thus repealed the Glass-Steagall Act which had been in place since 1932. It also prevented further regulation of risky fiscal derivatives. His deregulation of finance (both tacit and overt through GLBA) was criticized as a contributing factor to the Corking Recession.[ citation needed ] While he disputes that claim, he expressed regret and conceded that in hindsight he would have vetoed the pecker, mainly because information technology excluded risky financial derivatives from regulation, non because it removed the long-standing Glass-Steagall barrier betwixt investment and depository banking. In his view, even if he had vetoed the bill, the Congress would have overridden the veto, as it had nearly unanimous support.[ii]

Politifact in 2015 rated Clinton's claim that repeal of Glass-Steagall did not take "anything to practise with the fiscal crash [of 2008]" equally "Mostly True," with the caveat that his claim focused on removing the separation of investment and depository banking and not the broader exclusion of risky financial instruments (derivatives) from regulation.[41] These derivatives, such every bit the credit default swaps at the cadre of the 2008 crisis, were basically used to insure mortgage-related securities, with AIG the major provider. This encouraged more mortgage-related lending, as AIG theoretically stood behind the mortgage securities used to finance the mortgage lending. However, AIG was non finer regulated and did not have the financial resources to make expert on its insurance promises when housing defaults began and investors began to claim the insurance payments on mortgage securities in default. AIG collapsed spectacularly in September 2008, and became a conduit for a big authorities bailout (over $100 billion) to many banks globally to which AIG owed money, i of the darkest episodes in the crisis.[42]

Economic results summary [edit]

U.S. cumulative real (inflation-adjusted) GDP growth by President.[43]

The poverty charge per unit declined from 15.1% in 1993 to 11.9% in 1999. The number in poverty fell from 39.2 million in 1993 to 32.8 million in 1999, a reject of six.4 1000000.

Overall [edit]

Clinton presided over the following economic results, measured from Jan 1993 to December 2000, with alternate dates as indicated:

- Average existent GDP growth of 3.8%, compared to average growth of 3.1% from 1970 to 1992. The economic system grew every quarter.[44]

- Existent GDP per capita increased from about $36,000 in 1992 to $44,470 in 2000 (in 2009 dollars), about 23%, roughly the same as information technology did from 1981 to 1989 during the Reagan administration.[45]

- Aggrandizement averaged 2.half dozen%, versus 6.1% from 1970 to 1992 and three.0% in 1992.[46]

Labor market [edit]

- Non-farm payrolls increased by 22.7 million from February 1993 to January 2001 (236,000 per month average, the fastest on record for a Presidential tenure[47]) while noncombatant employment increased by 18.five million (193,000 per month average).[48]

- The unemployment rate was seven.three% in Jan 1993, fell steadily to 3.8% by April 2000 and was four.2% in January 2001 when his 2nd term ended. Information technology was beneath 5.0% later on May 1997.[49]

- Unemployment for African Americans vicious from 14.1% in January 1993 to 7.0% in Apr 2000, the lowest rate on tape.[49]

- Unemployment for Hispanics fell from eleven.iii% in January 1993 to five.ane% in October 2000, the lowest rate on record upwardly to that bespeak.[49]

Households [edit]

- Real median household income increased from $50,725 in 1992 to $57,790 in 2000, a xiii.9% increase.[fifty]

- The poverty rate declined from 15.1% in 1993 to xi.3% in 2000, the largest six-yr drop in poverty in well-nigh 30 years. The number in poverty cruel from 39.two million in 1993 to 31.58 million in 2000, a turn down of 7.6 million.[51]

- The homeownership charge per unit reached 67.7% near the end of the Clinton administration, the highest rate on tape. In contrast, the homeownership rate fell from 65.6% in the first quarter of 1981 to 63.7% in the showtime quarter of 1993.[52]

- Clinton worked with the Republican-led Congress to enact welfare reform. Every bit a outcome, welfare rolls dropped dramatically and were the everyman since 1969. Betwixt January 1993 and September 1999, the number of welfare recipients dropped by vii.5 meg (a 53% decline) to 6.6 million. In comparison, betwixt 1981 and 1992, the number of welfare recipients increased by 2.5 million (a 22% increase) to thirteen.6 meg people.[53]

Criticism [edit]

Clinton has been heavily criticized for overseeing the cosmos of the North American Free Trade Agreement (NAFTA), which made it more affordable for manufacturing companies to outsource jobs to foreign countries and then import their product back to the Us.

Some liberals and progressives believe that Clinton did non do plenty to contrary the trends toward widening income and wealth inequality that began in the late 1970s and 1980s. The superlative marginal income tax rate for high-income individuals (the acme one.2% of earners) was seventy pct in 1980, then lowered to 28 percent in 1986 by Reagan; Clinton raised it back to 39.vi percentage, but it remained far beneath pre-Reagan levels. Clinton'due south administration besides afforded no benefit to unionized labor and did not favor strengthening commonage bargaining rights.

Lower unemployment rates were another big part of Clinton's macroeconomic policies. Many fence that Clinton cost many Americans jobs because he supported complimentary trade, which some contend caused the U.South. to lose jobs to countries like Mainland china (Burns and Taylor 390). Even if Clinton did price Americans some jobs considering of free trade support, he immune for more jobs than were lost because the unemployment charge per unit of his presidency, and especially his 2nd term, were the lowest they had been in xxx years (Burns and Taylor 390). Others attribute this to sustained declines in interest rates, which fueled a booming stock market and job growth in a booming technology sector.

As mentioned previously, Clinton has been criticized by some observers every bit having played a long-term role in leading to the Great Recession with the aforementioned Gramm–Leach–Bliley Deed every bit well as the Commodity Futures Modernization Act of 2000.

Meet also [edit]

- Presidency of Neb Clinton

- New Democrats

- Back to Work: Why Nosotros Need Smart Government for a Strong Economy

- George W. Bush assistants economic policy

- Orbanomics

- Reaganomics

- Rubinomics

- U.S. economical performance under Democratic and Republican presidents

Notes [edit]

- ^ a b "CBO Budget and Economic Outlook 2016-2026 Historical tables". CBO . Retrieved Nov 23, 2016.

- ^ a b "Bill Clinton fires back at critics of his financial regulatory policies". The Hill. May fourteen, 2014. Retrieved November 23, 2016.

- ^ Jack Godwin, Clintonomics: How Bill Clinton Reengineered the Reagan Revolution (Amacom Books, 2009)

- ^ "Memo to Obama Fans: Clinton's presidency was not a failure". Slate. Retrieved February 13, 2005.

- ^ Speech communication by President Accost to Joint Session of Congress February 17, 1993 Archived March 26, 2007, at the Wayback Machine

- ^ "Request American to 'Face Facts,' Clinton Presents Plan to Raise Taxes, Cut Deficit". The Washington Post. February 18, 1993. Retrieved May 22, 2010.

- ^ U.Due south. Senate Scroll Phone call Vote – H.R. 2264 (Autobus Budget Reconciliation Act of 1993)

- ^ U.S. House Recorded Vote – H.R. 2264 (Omnibus Budget Reconciliation Human action of 1993)

- ^ Bryant, Nick (Jan xv, 2001). "How history will judge Nib Clinton". BBC News . Retrieved March 24, 2011.

That he has presided over the longest economical expansion in US history is undeniable. The US entered its 107th sequent month of growth terminal February.

- ^ Schifferes, Steve (January 15, 2001). "Pecker Clinton'south economical legacy". BBC News . Retrieved March 24, 2011.

- ^ "Government Shutdown Battle" – PBS

- ^ "The Budget and Deficit Nether Clinton". February 3, 2008 – via factcheck.org.

- ^ "Keynes was right". NYT . Retrieved December 30, 2016.

- ^ "Nib Clinton says his administration paid down the debt". PolitiFact.com. September 23, 2010. Retrieved March xx, 2011.

- ^ Elizabeth Drew, On the Edge: The Clinton Presidency (1994) pp 114–122.

- ^ Bruce F. Nesmith, and Paul J. Quirk, "Triangulation: Position and Leadership in Clinton's Domestic Policy." in 42: Inside the Presidency of Bill Clinton edited by Michael Nelson at al. (Cornell UP, 2016) pp. 46-76.

- ^ "The Economic and Budget Outlook:Financial Years 1999-2008". CBO. January 8, 1998. Retrieved Nov 23, 2016.

- ^ "Testimony on CBO's Spending Projections for the TANF and Federal Child Care Programs". CBO. March xvi, 1999. Retrieved Nov 23, 2016.

- ^ "The Outcomes of 1996 Welfare Reform". CBO. July 19, 2006. Retrieved December 31, 2016.

- ^ Kate Bronfenbrenner, 'We'll Close', The Multinational Monitor, March 1997, based on the study she directed, 'Final Written report: The Effects of Plant Closing or Threat of Plant Endmost on the Right of Workers to Organize'.

- ^ AFL CIO on Trade Archived 2011-05-11 at the Wayback Motorcar

- ^ Clinton on Foreign Policy at University of Nebraska Archived 2015-04-28 at the Wayback Motorcar

- ^ Address by Lawrence H. Summers, Deputy Secretary of the Treasury Archived September 27, 2007, at the Wayback Auto

- ^ Due north American Free Trade Agreement

- ^ http://world wide web.historycentral.com/Documents/Clinton/SigningNaFTA.html. Retrieved 02/xx/2011

- ^ Ringlet Phone call Vote – H.R. 3450

- ^ "Poll Results | IGM Forum". world wide web.igmchicago.org. 13 March 2012. Archived from the original on 22 June 2016. Retrieved 2016-01-01 .

- ^ "The North American Gratis Trade Agreement (NAFTA)" (PDF).

- ^ 2 Dec 2013"Contentious Nafta pact continues to generate a sparky debate" By James Politi

- ^ Security Increased for WTO Protests – PBS

- ^ Wrapping Upwards the WTO – PBS

- ^ Quango on Foreign Relations (2007). U.S.-Prc Relations: An Affirmative Agenda, a Responsible Course, p. 62

- ^ For his farm policies see Congressional Quarterly, Congress and the Nation: A Review of Government and Politics. Vol nine 1993-1996 (1998) pp 479-508; Congressional Quarterly, Congress and the Nation: Volume 10: 1997-2001 (2002) pp 417-428.

- ^ Bob Woodward, The Agenda (2002) pp. 127–128.

- ^ John W. Dietrich, "Interest groups and foreign policy: Clinton and the Red china MFN debates." Presidential Studies Quarterly 29.two (1999): 280-296 online.

- ^ CQ, Congress and the Nation: 1989–1992 (1993) p. 536.

- ^ Richard Lowitt, "Oklahoma's Mike Synar Confronts the Western Grazing Question, 1987-2000," Nevada Historical Lodge Quarterly (2004) 47#2 pp 77-111

- ^ Julie Andersen Hill, "Public Lands Council v. Babbitt: Herding Ranchers Off Public Land." BYU Police Review (2000): 1273+ online.

- ^ CQ, Congress and the Nation. Vol 9 1993-1996 (1998) p 496.

- ^ CQ, Congress and the Nation Vol 10 1997-2001 (2002) pp 130–140.

- ^ "Bill Clinton:Glass-Steagall repeal had nothing to do with fiscal crisis". Politifact.com. August 19, 2015. Retrieved November 23, 2016.

- ^ "Financial Crisis Enquiry Committee-Conclusions". FCIC.law.stanford.edu. January 2011. Retrieved November 23, 2016.

- ^ FRED-Real GDP-Retrieved July one, 2018

- ^ "FRED Real GDP". FRED . Retrieved November 22, 2016.

- ^ "FRED Real GDP per Capita". FRED . Retrieved December 30, 2016.

- ^ "FRED CPI and 10-Twelvemonth Treasury". FRED . Retrieved November 22, 2016.

- ^ "Job Creation by President". Politics that Piece of work. 2015.

- ^ "Civilian Employment and Full Nonfarm Payrolls". FRED . Retrieved December 19, 2016.

- ^ a b c "Unemployment rates past race". FRED . Retrieved December 30, 2016.

- ^ "FRED Real median household income". FRED . Retrieved April 5, 2017.

- ^ "Historical Poverty Tables". Census.gov . Retrieved Apr five, 2017.

- ^ Part of Management! and Budget; National Economical Council, September 27, 2000

- ^ HHS Assistants for Children and Families, December 1999 and August 2000; White House, Function of the Press Secretary, August 22, 2000

References [edit]

- Anonymous. Taxpayer Relief Act of 1997. File Tax.Com. viii Mar. 2008

- Bearding. "S&P 500." Standard & Poor's. eight Mar. 2008

- Midgley, James. "The U.s.: Welfare, Work, and Development." International Journal of Social Welfare ten:7 (2000): 284–293.

- Bartlett, Bruce. "Clinton Economics." NRO NationalreviewONLINE 7 July 2004. 8 March 2008

- "Pecker Clinton's Economic Legacy." BBC. 15 January 2001. British Broadcast Corporation. 8 March 2008

- Bartlett, Bruce. "Those Were the Days." The New York Times. 1 July 2004. 4 March 2008

- Burns, John W. and Andrew J. Taylor. "A New Democrat? The Economic Functioning of the Clinton Presidency." The Independent Review V.3 (2001): 387-408.

Further reading [edit]

- Congressional Quarterly. Congress and the Nation: Ix 1993-1996 (1998)

- Congressional Quarterly. Congress and the Nation: X 1997-2000 (2002)

- Frankel, Jeffrey A. and Peter R. Orszag, eds. American Economic Policy in the 1990s (2002) introduction

- Stiglitz, Joseph E. The roaring nineties : a new history of the world's most prosperous decade (2003) online

primary sources [edit]

- Economical Report of the President (annual) online

External links [edit]

- The Clinton Presidency: Historic Growth

Source: https://en.wikipedia.org/wiki/Economic_policy_of_the_Bill_Clinton_administration

0 Response to "what did clinton do to balance the budget"

Postar um comentário